property tax lawyer michigan

Although the proceeds from a life insurance policy will go directly to the named beneficiaries without probate they are considered part of your estate for federal estate tax purposes. All four forms of joint property leave the surviving owner with different rights.

Gregory A Nowak Lawyer State Local Tax Detroit Michigan Law Firm Of Miller Canfield

Relationships between landlords and tenants.

. Banks government entities and companies can use your Michigan tax ID number to identify your business. Tenants by the entireties. It can involve both real property such as an office building or personal property items like company tools or computers etc.

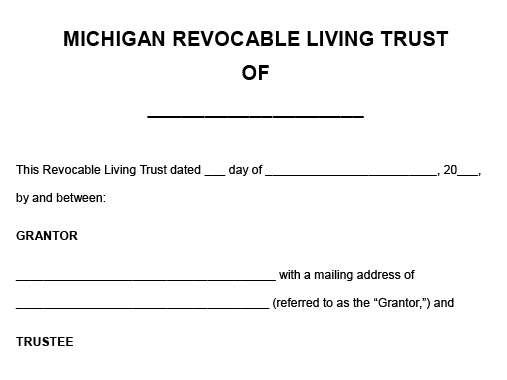

In Michigan you can jointly own property in four ways. This very simple form allows you to fill in your name and the names of your heirs the people who will execute your wishes after your death and any guardians needed for your minor children. Generally costs of probate and attorney fees vary from state to state and according to personal circumstances.

When it comes to hiring a lawyer to write a will specifically you can expect to pay anywhere from 300 to 1000. Others require the actual taking of money or property. However only California Maine Michigan New Mexico and Wisconsin offer statutory wills so many Americans wont have this option.

Before you can request a Michigan tax ID number for your business you will need to acquire an EIN from the IRS. Real estate rules vary by state so it is important to consult with a real estate attorney if you are buying a selling property with a land contract. Business or commercial property is property that is owned by a business or a company.

In West a debtor bought. Most property crimes include a spectrum of degrees depending on factors including the amount stolen and use of force or arms in theft related cases and actual or potential bodily injury in property destruction crimes. When dealing with complex joint property situations you may want to talk with a lawyer.

As a senior you may live on a low or fixed income which is why you might require help paying property taxesEven if you live in one of the states with low property taxes your tax bill could be too steep for you. Estate planning will cost different amounts depending on the individual. Also be sure any real estate broker involved in the transaction is familiar with land contracts.

In response effective January 1 2021 the Michigan Legislature amended the tax foreclosure statute to create a procedure for taxpayers to claim any excess proceeds. If youre worried about estate taxes -- and most people dont need to worry -- contact an attorney about ways to keep life insurance money out of your taxable. Michigan Federal Tax ID Number.

Business property may be subject to business property tax laws not usually applied to other types of property. And other matters pertaining to ones home or residence. There is something you can do before the bill arrivesapply for a senior citizen property tax exemption.

Some such as robbery require a victim present at the time of the crime. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. State Bar of Michigan 306 Townsend St Lansing MI 48933-2012 517 346-6300 800 968-1442.

Property and real estate laws also include zoning regulations which determine which kinds of structures may be built in a given location. A Breakdown of the Senior Citizen Property Tax Exemption. Property and real estate law includes homestead protection from creditors.

For a list of real estate attorneys in your state see Nolos Lawyer Directory. Joint tenants with full rights of survivorship. In Texas for example there is no limit on how much a landlord may.

Raj Malviya Attorney Grand Rapids Estate Planning

Michael P Coakley Lawyer Litigation Trial Intellectual Property Trade Secrets Detroit Michigan Law Firm Of Miller Canfield

Michigan Property Tax Uncapping Update Thk Law Llp

Gregory V Dicenso Attorney Taxation Law Estate Planning Troy Michigan Law Firm Of Miller Canfield

Real Estate Tax Lawyers Helping To Reduce Your Property Taxes

Schmidt Salzman Moran Ltd Property Tax Appeal Attorneys Schmidt Salzman Moran Ltd

The State Took Her Home Because She Missed 900 In Property Taxes

Taxation Law Attorney Robert Rhodes Taxation Law Practice

Estate Lawyer In Michigan 30 Years Experience

Resources For Property Tax Assistance Clearcorps Detroit

Estate Planning Attorney Rochester Hills Mi Will And Trust Rochester Law Center

Aptc American Property Tax Counsel Property Tax Reduction

Michigan Proposed Tax Due Letter Sample 1

Real Estate Tax Lawyers Helping To Reduce Your Property Taxes

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Steven M Stankewicz Lawyer Real Estate Corporate Kalamazoo Michigan Law Firm Of Miller Canfield

Real Estate Tax Lawyers Helping To Reduce Your Property Taxes